Good news.

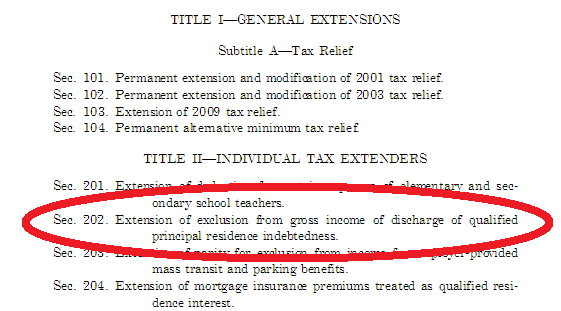

According to reliable sources, the late night deal to avert the fiscal cliff included an extension of the 2007 Mortgage Forgiveness Debt Relief Act which was to expire at midnight last night. According to the National Association of Realtors, and confirmed by the text in the screen shot of the bill:

Of most interest to real estate, the bill would extend mortgage cancellation relief for home owners or sellers who have a portion of their mortgage debt forgiven by their lender, typically in a short sale or foreclosure sale for sellers and in a modification for owners. Without the extension, any debt forgiven would be taxable, which, for underwater households, represents a financial burden.

Here is the clause referred to in the quote above:

The full text of the American Taxpayer Relief Act of 2012 can be found here and here. I know a number of home owners and colleagues in the industry who were concerned that the law would not be extended or languish in ambiguity until a retroactive extension, neither of which would have been particularly good.

There are details which are best discussed with your CPA and other professional financial adviser, and no broker like myself gives tax advice, so do consult with your accountant or lawyer. If you need a referral to a CPA or attorney familiar with the law, send me and email and I’ll be happy to put you in touch.

Bottom line: The business and tax ramifications of doing short sales did not change from the past 5 years, and if you are in the process of a short sale or considering one, a significant obstacle has been cleared. We can all exhale.

Update: Deal has been approved by both Congress and the Senate, and the President has signed it into Law.